Check out Part 1 of my investment series in collaboration with Sharesies here

Just like anything, instilling responsible financial habits in both ourselves and our kids takes both time, patience and practice. As I mentioned last month, we began contributing to the boys’ savings accounts as soon as they were born, setting up automatic payments of $10 per week and then essentially ignoring the accounts over the past 14 years. Obviously a very passive approach to saving but one that has easily become a fixture in the family budget.

Now that we are actively teaching the boys about investment diversity with the help of their Sharesies accounts, it’s time to level-up and get them thinking about their money, and where it’s going, on a more regular basis. If kids are earning pocket money, or if they receive money as a gift from friends and family, an easy way to foster a very intentional mindset towards saving is to introduce a spend/save/donate ratio which is in line with your family’s financial strategy. This is easy to implement from a super young age using low denomination coins and different envelopes, boxes or containers for spending, saving and donating.

Applying this practice of regular contributions to existing investments is also worthwhile implementing with our kids’ accounts. Many of us probably pay into our KiwiSaver accounts with uniform deposits via our pay schedules or, manually instigated automatic payments. As of last week, we can now do the same with our Sharesies investments – auto-invest is now live on the platform and it’s so easy to set up!

I’m all about automating as much of our family’s ‘Life Admin’ as possible – especially those voluntary tasks which can be easy to overlook like, savings and investment. I’ve had Christmas Club savings in place for over 10 years now at both a supermarket and The Warehouse and let me tell you, the value-add of decision free, locked-in saving each week results in a massive high five to yourself come Christmas time. Hooking up your Sharesies account with auto-invest is another one of those adult life hacks that you spend 5 minutes on now and end up patting yourself on the back for years to come.

Why use Auto-Invest

- Sharesies auto-invest helps you stick to an investment strategy that’s right for you. For Dave and I, this means contributing small amounts regularly to each of the boys Sharesies portfolios.

- Auto-invest helps you build on an investment when you don’t have a large, lump sum to begin with – which is what Sharesies is all about to be honest!

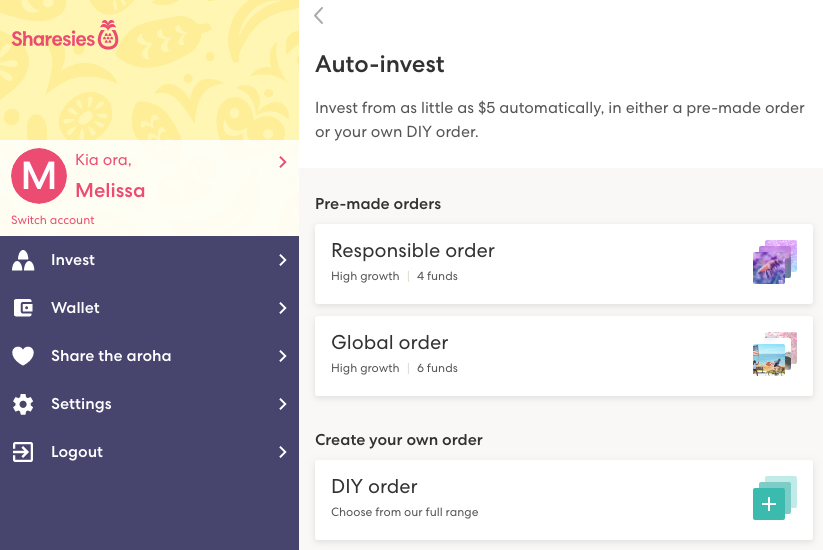

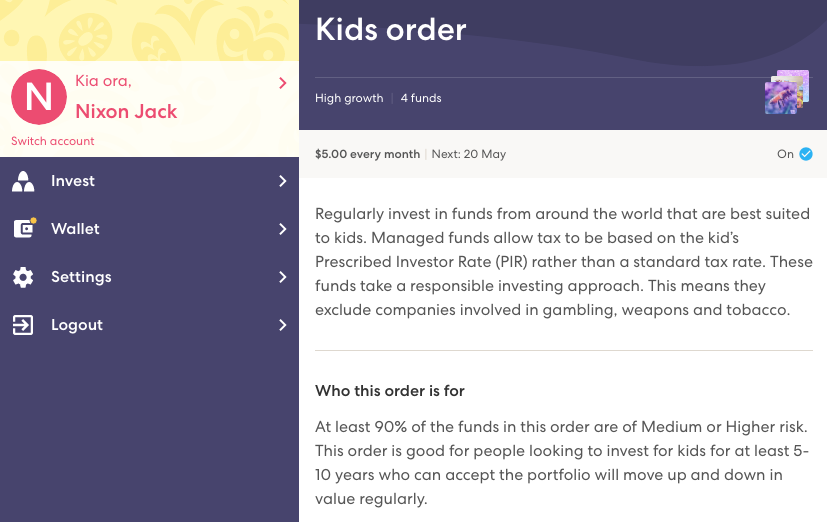

- With Sharesies auto-invest you can choose between 3 pre-made orders (one of which is specifically for kids accounts) or you can build your own DIY Order.

- Auto-invest is faster than setting up an AP via internet banking – I’m not exaggerating. I set up auto-invest on both boys Sharesies accounts in under 4 minutes total. The platform is so intuitive and easy I feel safe and confident with what I’m doing every time I log on.

I’m pretty excited about this new offering from Sharesies for a number of reasons, but probably top of the list is that from now on, the boys will be able to see the benefit and growth in their portfolios as a result of regular investing. Getting our ‘foot-in-the-door’ and being able to purchase shares in a way that is accessible and easy to understand is a game changer for families and individuals alike. Now with auto-invest, diversification of our savings investments is just as simple to automate and as free of fees as our Christmas Club at the supermarket (but maybe not quite so boring so I should be able to get the kids to pay attention at least once a month lol).

Follow

Follow